- CFO Playbook

- Posts

- Finance Systems & Automation: Why You Need a Dedicated Owner

Finance Systems & Automation: Why You Need a Dedicated Owner

We’re Ellen and Simone. After 36 years in finance, we’re ready to share what textbooks won’t tell you.

💛 Welcome to CFO Playbook – your practical finance insights delivered bi-weekly. The full read will take approximately 5 minutes. Like what you see? Share it! Use the button below.

READ OF THE WEEK

Everyone talks about AI, automation and modern finance tooling. But very few ask:

Who actually implements this in the finance team?

Not the Accountant. Not FP&A. And not "the CFO on the side".

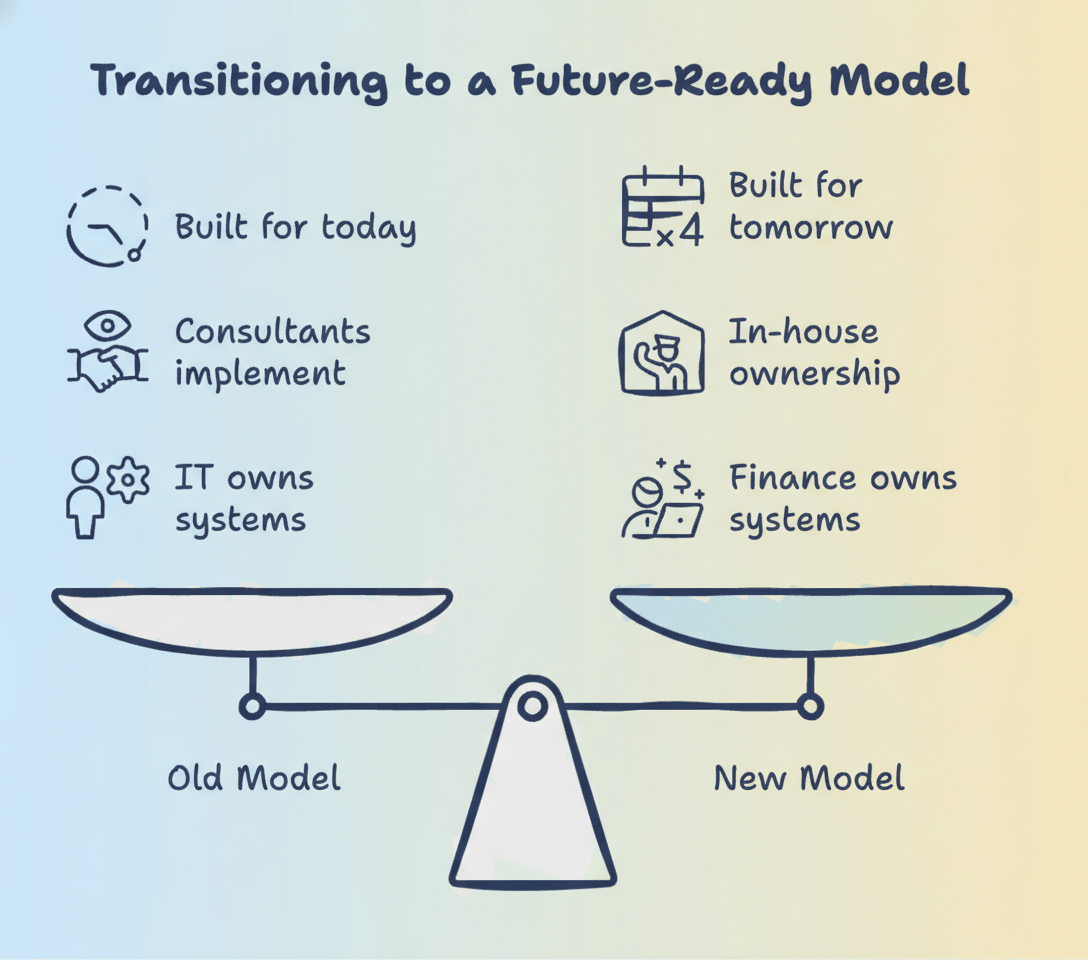

Historically, finance systems were owned by IT or Product. Finance consumed them but rarely shaped them. That model is breaking.

Important upfront: Automation and good systems are primarily about processes, data structure and tooling not AI. AI flows in naturally once the basics are right.

In this Read of the Week

1. Why Finance Automation Fails Without Ownership

2. What CFOs Must Define First

3. Where This Role Should Sit

4. Template Job Description

1) Why Finance Automation Fails Without Ownership

The finance tech stack has changed fast. Cloud ERPs. API-first architectures. AI-native tools daily. Automation platforms like n8n are becoming standard.

The challenge: CFOs need someone who understands both finance AND systems.

Real coding and data skills (SQL minimum, ideally Python). Everyone says you don't need to code anymore with AI. We disagree – without technical understanding, this role struggles.

Plus: deep knowledge of finance workflows (Quote-to-Cash, Procure-to-Pay, Month-End Close). And the ability to translate accounting into system logic. Rare combination.

Important: This is not the classic ERP System Owner who manages NetSuite or SAP. This role owns the entire finance tech architecture and automation strategy. Newly defined, not renamed

Without a dedicated owner, automation projects drift. IT builds what they think Finance needs. Finance complains. Spreadsheets return.

When does this role make sense?

Not because of AI – but because of complexity. We see the need at ~120–150 FTE with growth or internationalization plans. Often earlier with multi-entity setups, complex pricing, or M&A ambitions.

Small SaaS in Germany with 50 people? Full-time doesn't make sense. External or interim works better.

But wait until it "really hurts"? You pay later with Excel chaos and expensive re-implementations. Best finance teams build this earlier than necessary – not later.

Takeaway: You need a dedicated owner – not your ERP admin.

2. What CFOs Must Define First

Before hiring, CFOs need clarity on three questions:

Future reporting: What will management, board and investors ask for in 12–24 months?

Business growth: More entities? New countries? M&A? Usage-based pricing?

Compliance: IFRS vs. HGB vs. US GAAP, audit depth, controls

Without this, teams build for today's pain points only. Result: rework and "temporary fixes".

The CFO defines direction. The Finance Systems & Automation Manager executes.

The Data Model is Everything

At the heart of every scalable finance system: A well-defined data model. A data model defines how your financial data is structured, connected and named. The blueprint for how information flows through your systems.

Clear definitions (ARR, revenue, customers). One logic across Teams, ERP, BI, FP&A.

Get this wrong – no AI will save you. Deep-dive on clean data coming in a future newsletter.

Why In-House, Not Consultants

Consultants can help execute. But they don't know your processes, structures or business needs. They implement "best practice templates" without context.

An in-house owner understands strategy, knows future requirements, challenges vendor assumptions and can act in a much more agile way.

Takeaway: Strategic ownership cannot be outsourced.

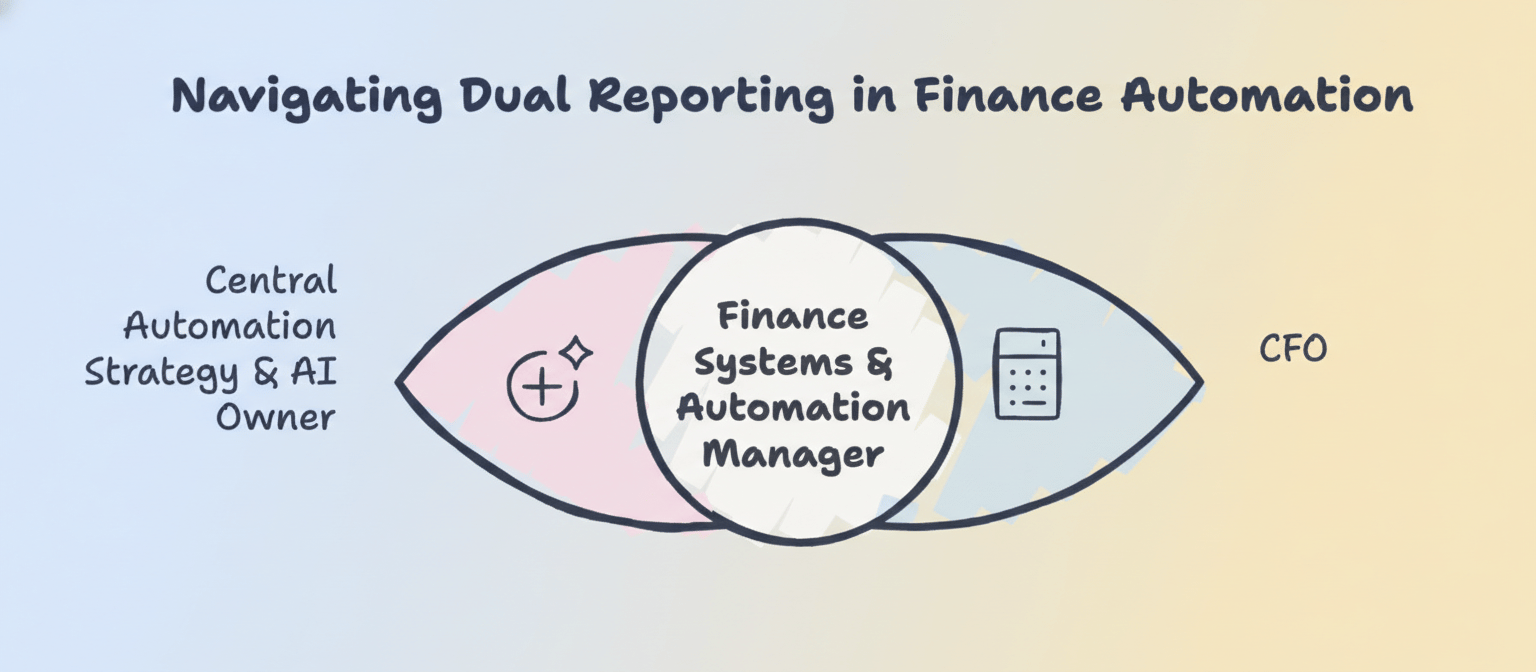

3. Where This Role Should Sit

Model A: Reports into CFO. Deep finance understanding. Speaks "finance language". Direct budget access.

Model B (recommended): Dotted Line to a central AI & Automation owner. Someone at company level who owns the entire AI and Automation strategy – often called "VP AI & Systems Architecture" or similar. Systems roles stay within their functions and have a dotted line to this role to stay aligned and avoid silos.

Why Model B matters:

Pure Finance ownership risks island solutions. Tools that don't integrate. Duplicate efforts. Technical debt.

In practice: This central role often doesn't exist yet. But every department is already experimenting on their own. Finance builds automations. Sales buys CRM add-ons. Ops tests workflow tools. None of it coordinated.

The risk? High costs. Island solutions. Tools get shut down because they don't fit strategy. Frustration because no one knows the direction.

Modern companies solve this with a clear, overarching systems and automation strategy. AI is part of it – but don't conflate the two. Automation is about processes and tooling. AI enhances it.

Every C-Suite needs this: an aligned automation roadmap that ensures a competitive tech stack. AI flows in naturally once the foundation is right.

Not standard everywhere – but growing fast.

Takeaway: Finance ownership + central automation coordination avoids island solutions. AI follows once the foundation is set.

4. Template Job Discription

Job Title: Finance Systems & Automation Manager

Reports to: CFO / VP Finance

Dotted Line: VP AI & Systems Architecture

Key Responsibilities:

Systems Architecture & ERP: Own cloud ERP (NetSuite, Workday, Microsoft Business Central, Rillet, Campfire…). Design integrations with Reporting Tools, Billing/CRM, HRIS, Spend Management, Banks.

Automation & Workflows: Build API integrations. Deploy automated reconciliation. Design low-code workflows (n8n, Make) for Quote-to-Cash and Procure-to-Pay.

Data & Reporting: Maintain Single Source of Truth. Build dashboards (SQL, Looker, Tableau) replacing Excel.

Technical Accounting: Translate IFRS/HGB/US GAAP into system logic. Support audits with logs and data extracts.

Must-Have:

5+ years Finance Operations or Systems (high-growth Tech preferred)

ERP experience (NetSuite, Workday, Microsoft Business Central)

Workflow automation (n8n, Make, Zapier; REST APIs)

Strong SQL

Nice-to-Have:

Accounting background (CPA, ACCA, Bilanzbuchhalter) – "system savvy"

Basic Python/JavaScript

Bottom Line

AI and Automation in Finance need a dedicated owner who thinks in systems, not tools.

Your move:

Don't have this role? Start thinking about it.

Hiring soon? Prioritize systems thinking. Consider a dotted line to avoid island solutions.

Already have someone? Give them a seat at company-wide AI/tech decisions.

Get the data model right first. No AI will save a broken foundation.

🔎 CFO Watchlist

Why AI won't replace accountants

Calculators didn't kill accounting. Spreadsheets didn't. AI won't either. The difference: Finance AI must be 100% accurate and auditable

"Good enough" doesn't work in accounting. Meanwhile, demand for accountants keeps rising.

CFO Action Plan 2026

Resilience, cost optimization, AI adoption, cybersecurity, talent development. Key takeaway: Technical skills alone aren't enough – finance teams need AI proficiency, storytelling and a business partner mindset.

🔗 CFO.com

🌐 Finance Collective DACH

Your go-to CFO Network (by Simone)

Join a curated network for:

Ask anything. Grow with your peers. Stay ahead. |  |

CLOSING REMARKS

Thanks for reading 💛

Send your feedback, suggestions, or requests to feature something in future editions to [email protected]. We’d love to include your input.

Follow us on LinkedIn for more updates!

CFO Playbook reflects our personal opinions, not professional advice.