- CFO Playbook

- Posts

- From Venture Capital to Private Equity: The CFO Shift

From Venture Capital to Private Equity: The CFO Shift

We’re Ellen and Simone. After 36 years in finance, we’re ready to share what textbooks won’t tell you.

💛 Welcome to CFO Playbook – your practical finance insights delivered bi-weekly. The full read will take approximately 5 minutes. Like what you see? Share it! Use the button below.

READ OF THE WEEK

If you’ve spent the last years in Venture Capital-backed land, you’ve been paid to live with uncertainty:

Unproven models, big markets

“High failure rate accepted”

Capital mostly equity, debt as a nice-to-have

Then the cap table shifts. A Private Equity fund shows up.

Suddenly the conversation moves from runway to EBITDA, from “what’s the story?” to “what’s the cash conversion?”, from “how big can this get?” to “how do we get our money back with a strong IRR?”

This newsletter is about that shift – what it really means when you move as a CFO from VC-backed environments into PE-backed ones, and how to decide whether you actually want that next chapter.

We observe this shift most clearly at the senior end of the market - CFO roles are moving from “story + growth” profiles to operators who can manage leverage, cash, and value creation under PE ownership.

In this Read of the Week

1. VC vs. PE: Different owners, different CFO job

2. Not All PE Is Created Equal: Common PE Playbooks

3. Inside the PE House: The Personas Every CFO Should Know

4. Working With PE Day-to-Day: From Reporter to Value-Creation Partner

5. Interviewing for a PE-Backed CFO Role: Questions That Put You in the Driver’s Seat

And one important caveat up front: there is no black and white. You’ll see every shade of grey:

Growth funds that behave like late-stage VCs

PE funds doing minority deals in founder-led rockets

Leveraged-Buyout (LBO) shops: PE funds that acquire companies mainly using debt running buy-and-build as if it were a Series C roll-upThe labels are fuzzy. The mindset and expectations are what matter.

1) VC vs. PE: Different Owners, Different CFO Job

Let’s start with the basics.

Investment stage & risk profile

VC: Early or growth stage, unproven models, high loss ratios baked into the strategy.

→ As CFO you manage uncertainty, burn rate and runway while pushing hard on growth – survival math and growth math in parallel.PE: Later-stage or mature companies with proven business models and more predictable cash flows.

→ The focus moves to operational leverage, margin expansion, and cash conversion.

Capital structure & leverage

VC: Mostly equity-funded, little or no debt to keep flexibility for growth.

PE: Uses leverage as a core value lever – different flavors, but capital structure optimisation becomes part of the value creation plan.

→ Now you’re managing banks, covenants, refinancing risk and interest costs every month.

Investment logic & value creation

VC: Value driven by top-line growth, market share and optionality (multiple expansion via “category winner” narrative).

PE: Value driven by EBITDA growth, cash generation and exit multiple, codified in a Value Creation Plan (VCP). from growth-at-all-costs → to profit & cash-flow optimization mindset.

The VCP translates the investment thesis into 3-7 concrete value levers (e.g. pricing, sales productivity, cost-out, buy-and-build, working capital).

Each lever comes with initiatives, owners, timelines, KPIs and impact in € / IRR.

For you as CFO, the VCP is basically the script: your budget, reporting, KPIs and board discussions all orbit around whether you are on track against that plan.

The numbers don’t just tell a story anymore – they have to show that the business can comfortably service its debt, stay within covenants, and deliver the returns the fund underwrote.

2. Not All PE Is Created Equal: Common PE Playbooks

“PE-backed” can mean very different jobs for the CFO.

Below are four common PE playbooks you’ll see in practice – and in reality, many funds blend elements of several of these in a single deal. This is not black and white: a “growth” fund can run a buy-and-build strategy, and a classic buyout can drift into restructuring if things go sideways.

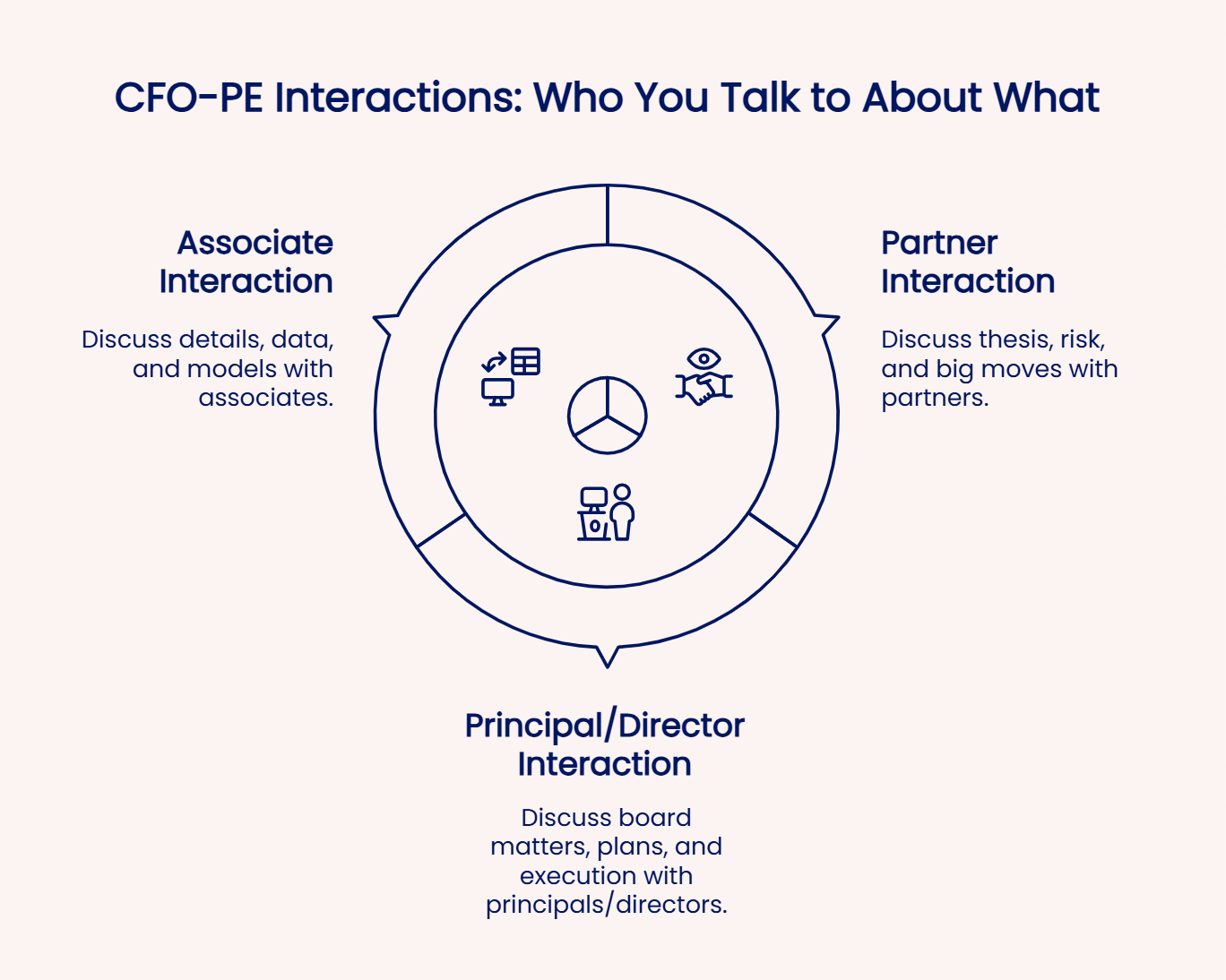

3. Inside the PE House: The Personas Every CFO Should Know

In PE land, you don’t just “talk to the fund”.

You work with different people at different levels – and each of them wants something slightly different from you. The main characters:

(1) Partner – Strategic Counterpart

Owns the investment and is accountable for the return.

Talks to you about thesis, risk, and big moves.

Wants clear headlines: Are we on track vs. the Value Creation Plan and IRR? Any surprises?

(2) Principal / Director – Your Day-to-Day Board Link

Usually sits on your board and runs the deal day-to-day.

Focuses on plan vs. actuals, initiatives, and early warning signals.

Your main partner for board prep and follow-up.

(3) (Senior) Associate – Your Number-Crunching Ally

Does much of the modelling and analysis behind the scenes.

Will ask you for the most granular input (by segment, product, cohort, country…).

Be friends with them: if they understand and trust your data, your life gets much easier.

4. Working With PE Day-to-Day: From Reporter to Value-Creation Partner

So what does the job actually feel like?

💡 Reality check: you will usually work much closer with a PE fund than you ever did with VCs – think weekly value-creation calls, ad-hoc deep-dives (pricing, churn, sales productivity, you name it) and regular lender interactions.

🕵️♀️Transparency: the “no surprises” rule. In PE, bad news early beats bad news late.

Pre-wire issues: “We’re tracking 5% below plan – here are three fixes.”

Reforecast when reality changes, not at year-end.

Use ranges and scenarios, not fake precision.

Trust is your most important asset with your investors.

🎯 Decision backbone: The pack is not the point – the decisions are.

Use unit economics, cohorts and process KPIs to challenge the plan.

Bring 2–3 options with impact and trade-offs, not a data dump.

Link board-level value creation to team targets and budgets.

📊 Boundaries & focus: Channel questions into decision-focused analysis.

Align early on a standard data model and KPI set.

Prioritise work that clearly supports real decisions.

Build FP&A and data so most questions can be answered on demand.

Your job is to be scalable, not to be personally heroic.

5. Interviewing for a PE-Backed CFO Role: Questions That Put You in the Driver’s Seat

In a PE interview, you’re not just being assessed. You’re also underwriting a 3-7 year relationship.

Here are questions that signal you think like an investor and an operator.

Bottom Line

Moving from VC-backed to PE-backed isn’t just a new logo on the cap table.

In VC, you’re paid to manage uncertainty and fuel growth.

In PE, you’re paid to manage leverage, cash and a Value Creation Plan - and hit the IRR you all signed up for.

Your edge as a PE CFO:

→ You understand the Playbook (buyout, growth, roll-up, turnaround)

→ You know your stakeholders (Partner, Principal, Associate) and speak to each at the right altitude.

→ You run a finance engine built for no surprises, sharp decisions and scalable analysis, not heroics.

Get those three right, and you’re not “the person who sends the pack” anymore –

you’re the partner PE calls first when something really matters.

🔎 CFO Watchlist

1. Anthropic launches Claude Opus 4.5 – now living inside Excel

Anthropic has released Claude Opus 4.5, its new flagship model, positioned as “the world’s most powerful model for programming, agents, and computer control” and outperforming Gemini 3 on several coding benchmarks.

The CFO-relevant bit: Claude now moves into your spreadsheets.

Claude for Excel adds a chat panel directly into Excel so you can query, clean, and edit sheet data in place (Max, Team, Enterprise plans).

New tooling supports longer-running “agents” and tighter integration with Chrome and desktop workflows.

That’s interesting for finance teams because, let’s be honest, Copilot for Excel is still pretty underwhelming for real-world ops work.

Anthropic also added an effort parameter to the API so developers can control how hard the model “thinks” about a task – useful for heavy analytics runs on large workbooks.

🔗 Check it out here: Claude for Excel | Claude

2. OpenAI’s lead under pressure as Google and Anthropic catch up

Google’s Gemini 3 and Anthropic’s Claude are closing the gap to OpenAI, helped by Google’s in-house chips and distribution and Anthropic’s fast-growing enterprise focus. OpenAI still has the biggest chatbot footprint, but faces massive compute spend and tougher monetisation questions. For CFOs, the signal is clear: plan for a multi-vendor AI stack, faster model cycles, and more room to negotiate on price and performance.

3. Lovable & VAT: Compliance before Product?

The Lovable VAT discussion highlights a broader issue for European SaaS: startups are expected to run full cross-border VAT compliance from invoice one (OSS, reverse charge, VAT ID checks), while in the US tax obligations often kick in only after reaching scale. That’s why some EU teams route billing via US entities to “buy time”. The core idea for policymakers: keep the taxes, but shift when they apply – with grace periods, a unified SaaS VAT regime, and more automation via Stripe/PayPal – so founders build products before they build tax departments.

🔗 Read more: (99+) When European SaaS Companies Invoice Through the US. What the Lovable Case Might Be Telling Us | LinkedIn

4. “Hold forever” funds are buying up VC ‘zombies’

Investors like Bending Spoons and Curious are building portfolios of stalled VC-backed SaaS companies (Evernote, Meetup, UserVoice, etc.), buying them cheaply, cutting costs, hiking prices and then holding them for cash, not exit. The playbook: buy at ~1x ARR, centralise GTM/overheads, push margins to 20–30% and recycle the cash into more acquisitions. For CFOs, this is PE-style discipline without an exit clock - profitability, cash generation and shared services matter more than “VC-scale” growth.

🌐 Finance Collective DACH

Your go-to CFO Network (by Simone)

Join a curated network for:

Ask anything. Grow with your peers. Stay ahead. |  |

CLOSING REMARKS

Thanks for reading 💛

Send your feedback, suggestions, or requests to feature something in future editions to [email protected]. We’d love to include your input.

Follow us on LinkedIn for more updates!

CFO Playbook reflects our personal opinions, not professional advice.