- CFO Playbook

- Posts

- The modern CFO's Treasury Playbook

The modern CFO's Treasury Playbook

From Cash Reporting to Cash Action: What Modern Treasury Actually Looks Like

We’re Ellen and Simone. After 36 years in finance, we’re ready to share what textbooks won’t tell you.

💛 Welcome to CFO Playbook – your practical finance insights delivered bi-weekly. The full read will take approximately 5 minutes. Like what you see? Share it! Use the button below.

READ OF THE WEEK

Treasury used to be about knowing your numbers. Today, it's about acting on them.

Most CFOs can tell you yesterday's cash balance. The best ones can tell you what to do about tomorrow's.

The game has changed: Cash moves faster, markets move 24/7, and the window between insight and action keeps shrinking.

Gurjit Pannu led treasury at scale for over a decade from optimizing operations at Levi's to supporting hypergrowth at Uber and building 0-to-1 at Remote. He's seen the full spectrum of treasury needs across businesses in different stages of their lifecycle. Today, he's building Palm to address the treasury challenges he saw firsthand across those journeys.

His insight?

The problem isn't cash visibility anymore. It's cash confidence.

Knowing what the numbers mean and what to do about them.

We sat down with Gurjit to get his take on the questions CFOs keep asking us about modern treasury.

In this Read of the Week

1. Intraday Visibility - When daily cash views aren't enough anymore

2. Short vs. Long - Why most teams confuse cashflow planning timeframes

3. Direct vs. Indirect Cashflow Method - The #1 mistake CFOs make

4. The Tooling Tipping Point - When Excel stops working

5. AI-Era Treasury - What separates good treasurers from great ones

1. Intraday Visibility - When Daily Cash Views Aren't Enough Anymore

Treasury questions used to be simple: "What was our ending cash balance last week?"

Today's reality is different:

"What's our cash at 10am after merchant payouts but before settlements?"

"When exactly do those FX trades settle?"

Who needs this: High-velocity businesses - marketplaces, payments platforms, global subscription models, B2C refund flows. They can't wait until EOD to know where they stand.

Who doesn't (yet): Traditional B2B with predictable cycles. Daily visibility often suffices.

What's changing: Real-time money movement plus tokenized investments are advancing fast. This combination unlocks tangible value - but only with real-time visibility to act on it.

The trigger: If your team is constantly reactive - scrambling to explain variances, missing fundings, running into shortfalls - you've already crossed the threshold.

Tomorrow, every company will need real-time visibility to extract full value from their cash.

Key Takeaway: Intraday isn't about perfection. It's about closing the gap between when cash moves and when you can act on it.

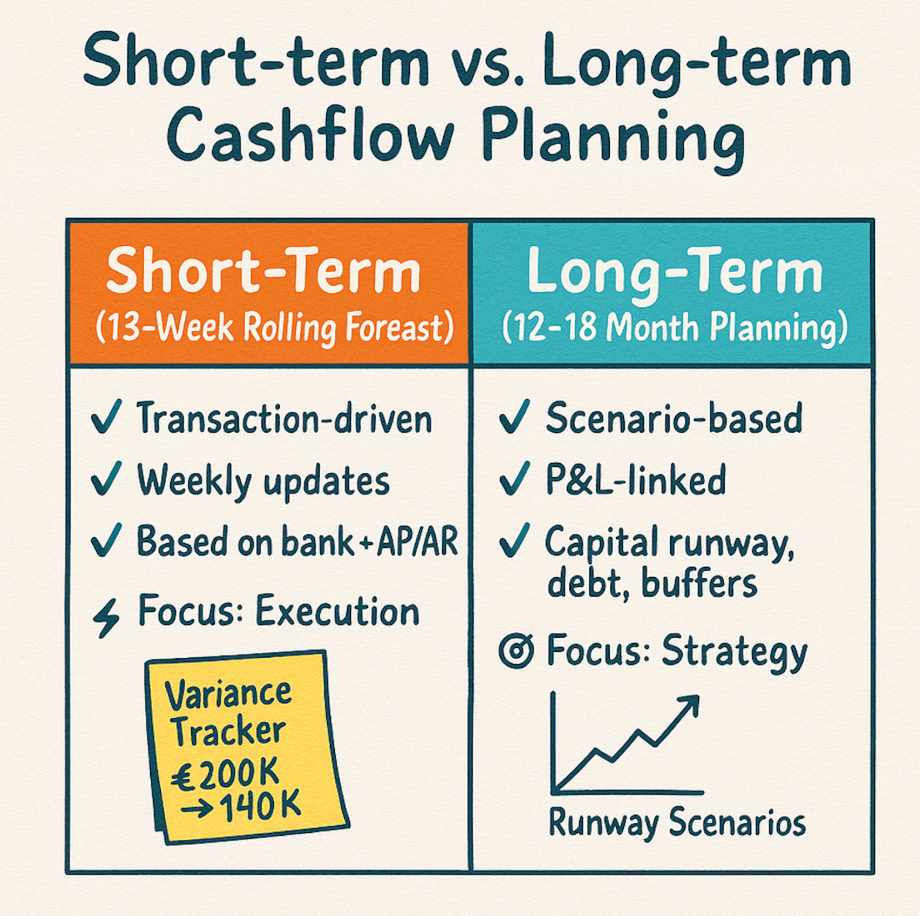

2. Short vs. Long - Why Most Teams Confuse Cashflow Planning Timeframes

CFOs keep asking: "What are best practices for cashflow planning - short-term vs. long-term?"

The real problem? Most teams try to use one approach for both. That's where planning breaks down.

Short-Term Planning (13-Week Rolling Forecast)

This should be transaction-driven, updated weekly, and built directly on bank movements plus AP/AR schedules - not GL assumptions.

The most effective teams don't just track the number. They track variance every week: "Forecasted €200K, received €140K due to X."

Success isn't just about accuracy. It's about closing the feedback loop fast.

Long-Term Planning (12-18 Months)

This should be scenario-based and P&L-linked, not transactional.

Use it to model capital runway, debt headroom, liquidity buffers, dividend strategy, funding needs - not day-to-day cash.

The Biggest Challenge

Teams confuse the two:

They try to make a long-term plan as granular as a 13-week forecast

Or they keep a short-term plan too static, treating it like annual planning

Short-term is execution. Long-term is strategy.

Run both, but never mix them.

Key Takeaway: If your 13-week forecast feels like guesswork, you're probably building it top-down. If your 18-month plan feels like busywork, you're probably building it bottom-up.

3. Direct vs. Indirect Cashflow Method - The #1 Mistake CFOs Make

The textbooks explain the technical difference. But what matters in practice?

Direct Method (Bottom-Up, Actual Cash Flows)

Best for: Short-term operational planning, especially when you need to coordinate when cash goes out vs. when cash comes in.

Pros: Highly accurate if input data is reliable.

Cons: Data collection is painful without automation.

Indirect Method (P&L-Based, Adjusted from Accruals)

Best for: Long-term planning, investor reporting, and FP&A alignment.

Pros: Easy to maintain, clean integration with board materials.

Cons: Often too abstract for treasury action.

The #1 Mistake

Trying to choose one.

In practice, best-in-class treasury operations run both:

Direct for execution (what do I pay and when?)

Indirect for strategy (what does the board need to see?)

They serve different purposes. Don't force them into the same box.

Key Takeaway: The method isn't the problem. The problem is using the wrong method for the wrong question. When definitions differ, data becomes ammunition.

4. The Tooling Tipping Point - When Excel Stops Working

The treasury tech landscape is crowded: Atlar, Kyriba, Embat, Agicap, Palm...

So when do you actually need one?

The Reality Check

If you have fewer than 5 bank accounts and cash moves slowly, Excel and bank portals still work fine.

The tipping point typically happens when either:

(a) You spend more than 4 hours per week manually consolidating balances, or

(b) Forecast variance becomes unexplainable due to fragmented data

What to Look For

Don't start with feature lists. Start with one question:

"Will this get me from insight to action faster?”

Look for platforms that:

Integrate cleanly (ERP, banks, subsidiaries)

Automate reconciliation

Deliver variance insights, not just dashboards

The shift is clear: Newer systems focus on proactive insights vs. the data aggregator role of traditional systems.

Key Takeaway: The best tool is the one that gets you from "What happened?" to "What should I do?" the fastest.

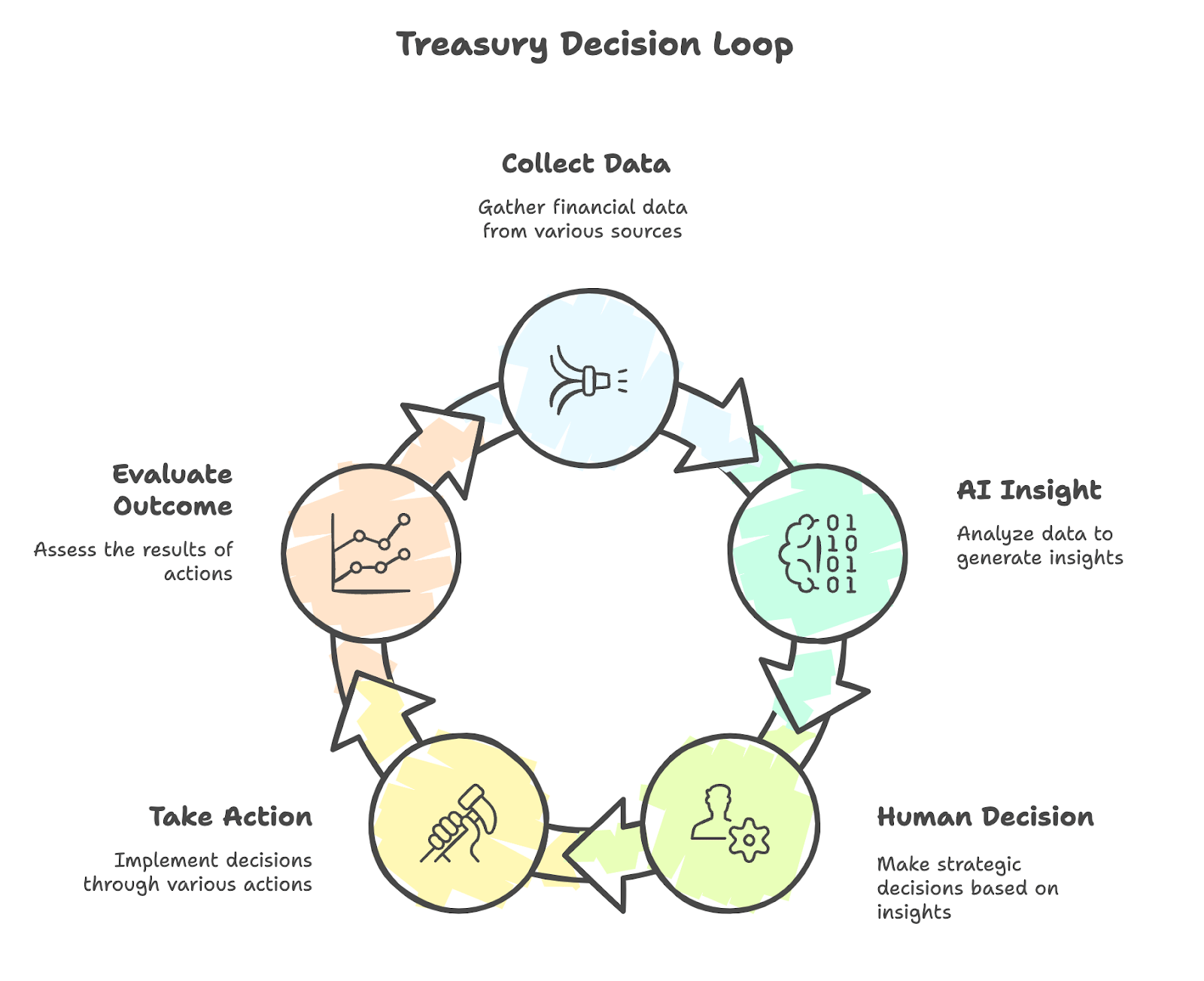

5. AI-Era Treasury - What Separates Good Treasurers from Great Ones

AI will handle 90% of the mechanics: reconciliation, categorization, forecast baselining, anomaly alerts.

So what's left for humans?

The Real Work Begins

Great treasurers will be the ones who use those signals to take action:

Renegotiate credit lines

Optimize hedging strategies

Deploy excess cash faster

Redesign policies proactively

AI gives you the insight. Treasurers decide what to do with it.

The difference between good and excellent treasury won't be who knows the numbers.

It'll be who moves first on them.

Key Takeaway: Treasury is shifting from a reporting function to a decision function. The winners will be those who stop asking "What happened?" and start asking "What now?"

Bottom Line

Cash visibility isn't the constraint anymore - cash confidence is.

The modern CFO's treasury edge isn't about having more data. It's about having better decisions, faster.

That means:

Real-time visibility where velocity demands it

Separate forecasts for execution vs. strategy

Both direct and indirect methods, not either/or

Tools that reduce decision latency, not add reporting layers

Humans who act on AI insights, not get replaced by them

So here's the question: Is your treasury function telling you what happened - or what to do next?

🔎 CFO Watchlist

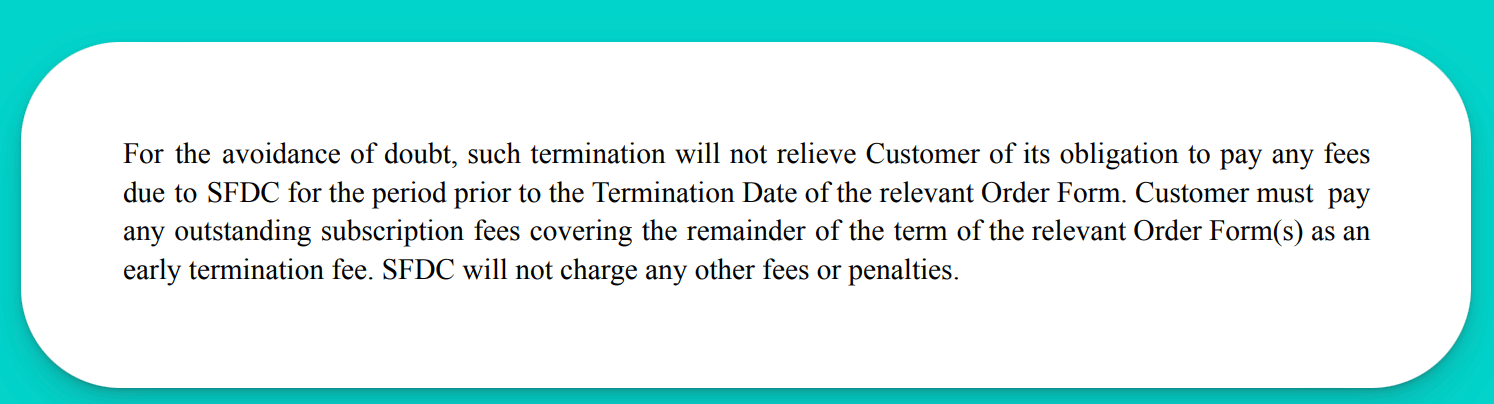

Update: EU Data Act SaaS Contracts

Vendors are starting to update their contract framework, Salesforce example: You can terminate early, but still owe 100% of remaining fees as "early termination fee."

Interesting LinkedIn reads:

Anthropic just released Claude "Skills"

Building a 3-statement financial model - the test where every LLM has historically failed. Skills let Claude load specialized instructions automatically. Available on Pro/Max/Team/Enterprise. 🔗 LinkedIn discussion

OpenAI hired 100+ ex-bankers to do one thing: build financial models

Goldman, JPM, and Morgan Stanley talent is now training AI on financial modeling. What does this mean for banking and for finance teams? 🔗 LinkedIn discussion

Interesting read: Finance Trends 2026

Survey of 1,326 global finance leaders from around the world and across industries:

AI adoption gap: 63% use it, but only 21% see clear ROI

Priority: Hiring tech talent (AI, data analytics) for finance teams

57% are now top influencers shaping company strategy (shift from pure finance support to proactive growth drivers)

30% strengthening scenario planning, 28% building agile governance for faster decisions

Cost-focused CFOs deploy cloud (48%) and AI (43%) for measurable value

The CFO role is expanding beyond the books.

🌐 Finance Collective DACH

Your go-to CFO Network

(by Simone)

Looking for a place where you & your Team can connect with like-minded Finance Leaders? |  |

CLOSING REMARKS

Thanks for reading 💛

Send your feedback, suggestions, or requests to feature something in future editions to [email protected]. We’d love to include your input.

Follow us on LinkedIn for more updates!

CFO Playbook reflects our personal opinions, not professional advice.