- CFO Playbook

- Posts

- Why M&A Happens - and When CFOs Should Say No

Why M&A Happens - and When CFOs Should Say No

Part 1 of our Mini-Series on M&A

We’re Ellen and Simone. After 36 years in finance, we’re ready to share what textbooks won’t tell you.

💛 Welcome to CFO Playbook – your practical finance insights delivered bi-weekly. The full read will take approximately 5 minutes. Like what you see? Share it! Use the button below.

READ OF THE WEEK

Over the next two episodes, we’ll strip M&A back to first principles - not how deals are done, but why they should be done at all and how CFOs can tell whether they actually worked.

This first episode is about decision quality: how CFOs should think before models, advisors, and momentum take over. The second looks at accountability: how to tell, after signing, whether a deal delivered what you actually bought.

And yet, this is rarely how M&A conversations begin.

Most M&A discussions start with valuation.

That’s already a mistake.

Before you open a model, hire advisors, or argue about multiples, there’s a much simpler question that determines whether a deal will ever work:

Why are we doing this at all?

In practice, most M&A doesn’t fail because the spreadsheet was wrong.

It fails because the reason for the deal was never clear - or wasn’t honest.

So let’s start where CFOs should start.

In this Read of the Week

1. Why Companies Do M&A (and Why Many Shouldn’t)

2. Why This Deal, Why Us, Why Now

3. Valuation Is a Consequence, Not a Rationale

4. The Business Case That Actually Matters

5. Structuring for Uncertainty

1) Why Companies Do M&A (and Why Many Shouldn’t)

At its core, M&A is a capital allocation decision.

You are taking a large amount of capital - cash, equity and management attention - and betting that buying something creates more value than:

investing further in your own business

returning capital to shareholders

or simply doing nothing

That framing matters, because it immediately narrows the field.

In reality, there are only a few legitimate reasons to do M&A:

📈 Accelerate a proven strategy

🛠️ Buy capabilities instead of building them

🏗️ Consolidate economics (cost, capital, structure)

🔄 Redirect capital to higher-return opportunities

Everything else tends to be noise.

The bad reasons show up again and again:

trying to mask a weak core business

chasing growth optics

deal momentum disguised as strategy

ego, fear, or the pressure to “do something”

Here’s the uncomfortable truth CFOs need to internalize early: If the core business isn’t healtyh, M&A will amplify the problem - not fix it.

That’s why strong CFOs treat M&A as optional, not inevitable. And why the real work starts long before valuation ever enters the room.

2. Why This Deal, Why Us, Why Now

Most deals don’t fail because the answers to these questions were wrong. They fail because nobody ever forced the organization to answer them clearly.

Once you accept that M&A is optional - not inevitable - the bar should rise fast.

As a CFO, a simple forcing mechanism helps:

If the deal rationale doesn’t fit on one slide, the deal isn’t ready.

Every transaction should be able to answer three questions, clearly and concisely:

Why this deal?

What problem does it solve that organic execution does not?

Why us?

What makes us the natural owner? What value can we extract that others can’t?

Why now?

Why is this moment better than later - or never?

Then comes the question that often kills weak deals:

What happens if we don’t do this deal?

If the honest answer is “not much,” that tells you something important.

This is where CFOs add real value - not as deal killers, but as guardians of timing and opportunity cost. Saying “not yet” is often the highest-return decision in the room.

If one corner is weak, the triangle collapses.

3. Valuation Is a Consequence, Not a Rationale

Valuation models are powerful - and that’s exactly why they’re dangerous.

We´ve seen too many finance teams disappear into spreadsheets, trying to build the perfect model. Weeks spent refining assumptions and formulas, only for the deal to underperform anyway - not because a formula was wrong, but because the underlying case wasn’t as robust as everyone wanted to believe.

Your goal isn’t to get the model “1000% right.”

Your goal is to understand the case.

Focus on the work that actually matters:

Run sensitivity analysis on the handful of assumptions that drive most of the value (growth, margin, retention/churn, pricing, CAC efficiency, working capital, integration timing).

Then ask the more powerful question: What has to be true for this deal not to work out?

That question beats perfectionizing the last details in row 1021 - because it forces you to confront downside and execution risk, not just arithmetic.

4. The Business Case That Actually Matters

Behind every deal approval sits a business case.

And almost every business case looks good on paper.

The difference between good and bad M&A is not whether synergies exist - it’s whether you actually understand them.

If you can’t explain:

where a synergy comes from,

who is responsible for delivering it, and

when it should show up in the numbers,

then it’s not a synergy. It’s a hope.

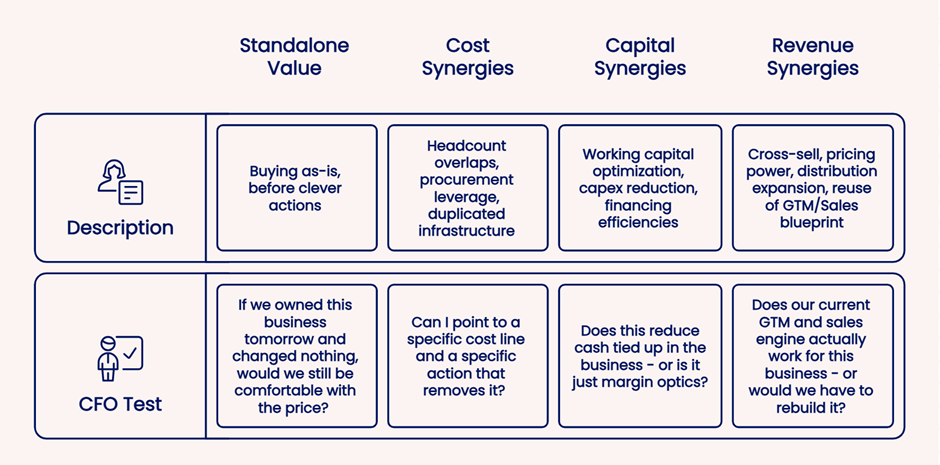

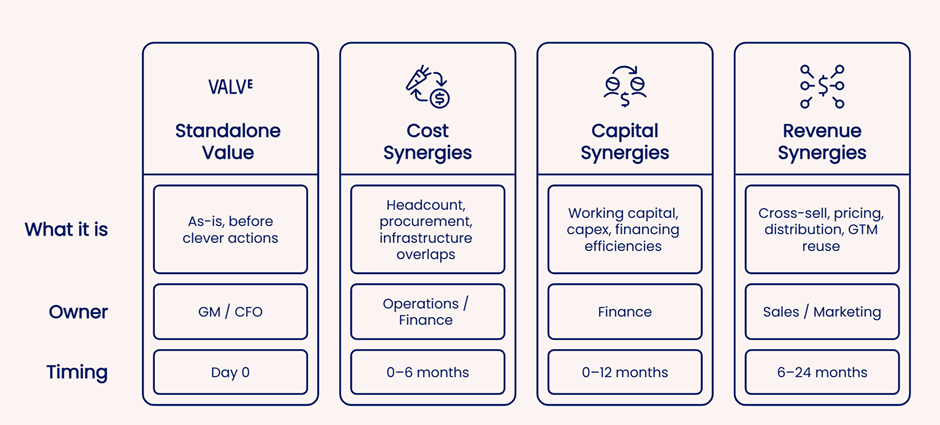

A strong business case separates value creation clearly:

This structure matters for one simple reason:

If you model synergies properly upfront, you can track them later.

Too many models bake synergies invisibly into growth or margin assumptions. That makes deals easier to approve - and impossible to manage post-close.

CFO discipline:

Every synergy in the model should be traceable to a real operational action and a real owner.

If you wouldn’t be comfortable holding someone accountable for it six months after close, it shouldn’t be underwriting your price today.

5. Structuring for Uncertainty

Every deal comes with uncertainty.

That part is unavoidable.

Good CFOs acknowledge it.

They flag the risks in the investment memo, document the assumptions, and make sure the board is aware of where things could go wrong.

Great CFOs go one step further.

They don’t just describe uncertainty - they price it.

That doesn’t mean overengineering the deal or inventing complex structures for the sake of sophistication. Quite the opposite. The best structures are usually simple:

earn-outs tied to a small number of real drivers

deferred consideration

escrows for clearly defined risks

rollovers that keep skin in the game

The goal isn’t elegance.

The goal is alignment.

If value depends on future execution, future performance should carry future payment.

Where this often breaks down isn’t design - it’s follow-through. Too many structures are agreed at signing and quietly abandoned afterward, turning clear mechanics into political debates instead of measurable outcomes.

Hard truth:

A structure you don’t actively manage is just expensive decoration.

Great CFOs stay close:

they define how success will be measured before close

they make ownership explicit

and they follow up, period by period, even when it’s uncomfortable

Because the deal you regret most is rarely the one you lost - it’s the one where you took all the risk upfront and hoped execution would sort itself out.

Bottom Line

If you can’t explain:

➜ Why a deal exists

➜ Why you are the right owner

➜ What happens if things go wrong

without opening a spreadsheet, you’re not ready to do M&A.

Before approving your next deal, try this instead: Start with the five CFO tests from this episode - without a model.

If the deal only works in a model, it doesn’t work.

🔎 CFO Watchlist

Join our Webinar: From Trial Balance to CFO Dashboard in 30 Minutes

(👉 sign up here: Claude in Excel: Your New AI Finance Superpower · Luma)

Still building Excel models formula by formula? There’s a better way.

CFO Playbook x Finton Advisors are hosting a free live demo on how Claude + Excel can transform financial modeling - from trial balance to CFO dashboard in under 30 minutes.

What to expect:

→ Claude vs. Gemini Add-Ins: setup & when to use what

→ Live build: Trial Balance → 3-Statement Model → Dashboard

→ AI-generated Management P&L, variance analysis & commentary

→ Bonus: Ad-hoc questions like “Why did gross margin drop in Q3?”

Who should join: CFOs, Heads of Finance, FP&A leads, and finance teams curious how modern finance actually works today.

👉 Sign up here: Claude in Excel: Your New AI Finance Superpower · Luma

🌐 Finance Collective DACH

Your go-to CFO Network (by Simone)

Join a curated network for:

Ask anything. Grow with your peers. Stay ahead. |  |

CLOSING REMARKS

Thanks for reading 💛

Send your feedback, suggestions, or requests to feature something in future editions to [email protected]. We’d love to include your input.

Follow us on LinkedIn for more updates!

CFO Playbook reflects our personal opinions, not professional advice.