- CFO Playbook

- Posts

- Management Accounting: From Ledgers to Levers

Management Accounting: From Ledgers to Levers

We’re Ellen and Simone. After 36 years in finance, we’re ready to share what textbooks won’t tell you.

💛 Welcome to CFO Playbook – your practical finance insights delivered bi-weekly. The full read will take approximately 5 minutes. Like what you see? Share it! Use the button below.

READ OF THE WEEK

Most finance teams close their books perfectly…and learn nothing.

✅ The numbers tie out. The auditors smile.

⚠️ But nobody can say what to do next.

Statutory accounting reports the past. Management accounting explains performance.

When R&D drowns in G&A and leases hide in depreciation, EBITDA looks fine while cash burns. The numbers are right.

The decisions are blind.

Management Accounting rebuilds the lens around how the business runs, not how it reports.

It’s the shift from ledgers to levers - from recording history to steering what happens next.

Simone started her career in accounting obsessing over IFRS adjustments, making sure every line reconciled perfectly. At first, she didn't get why the CFO barely glanced at them. She learned fast: those reports are critical for tax, compliance, and audits - but they don't steer the business. That's the shift more accounting teams need to make.

In this Read of the Week

1. What Management Accounting is - and what it isn’t

2. Why It Matters - the difference between knowing and acting

3. Build the Pack - without boiling the ocean

4. The Rhythm That Makes It Work - from close to consequence

5. From Insight to Execution - data, tools, and a bit of AI

1) What Management Accounting is - and what it isn’t

Spoiler alert: despite the name, management accounting isn’t really about accounting.

It’s not about ticking boxes or closing the books - it’s about running the business. Management accounting turns financial data into decisions: showing where margin was earned or lost, what drove it, and what to do next. It’s the internal lens that helps managers steer - contribution by stream, cost by driver, action by owner. Built for decisions, not disclosure.

What it is

A forward-looking view of performance - where margin was earned or lost.

Driver-based analysis that links operational metrics to financial impact.

Clear next steps with owners and timelines.

What it isn’t

A statutory P&L reshuffled for convenience.

IFRS/GAAP layouts that explain compliance, not cause and effect.

Endless variance columns that drown signal in noise.

How it runs

Weekly: operational pulse - leading indicators, quick course corrections.

Monthly: management accounts - one lens on performance and decisions.

Quarterly: strategy check-ins - the long view built on twelve short ones.

In short: keep the structure stable, so the team debates the numbers - not the format.

Example:

Statutory view: "Marketing expenses up 15% vs budget"

Management view: "CAC in NL broke payback (15 months). DE still works (6.5m). Shift €120k."

One explains compliance. The other drives action.

2. Why it Matters - the difference between knowing and acting

Capital is selective again. Growth only works when the unit economics hold - and even small drifts (a rising CAC, a softening conversion, an uptick in churn) can quietly break an otherwise “good” model.

That’s why management accounting matters: it’s the early-warning system that translates numbers into moves. A monthly pack that exposes what changed - and turns that into decisions - is the difference between a quick correction and a post-mortem.

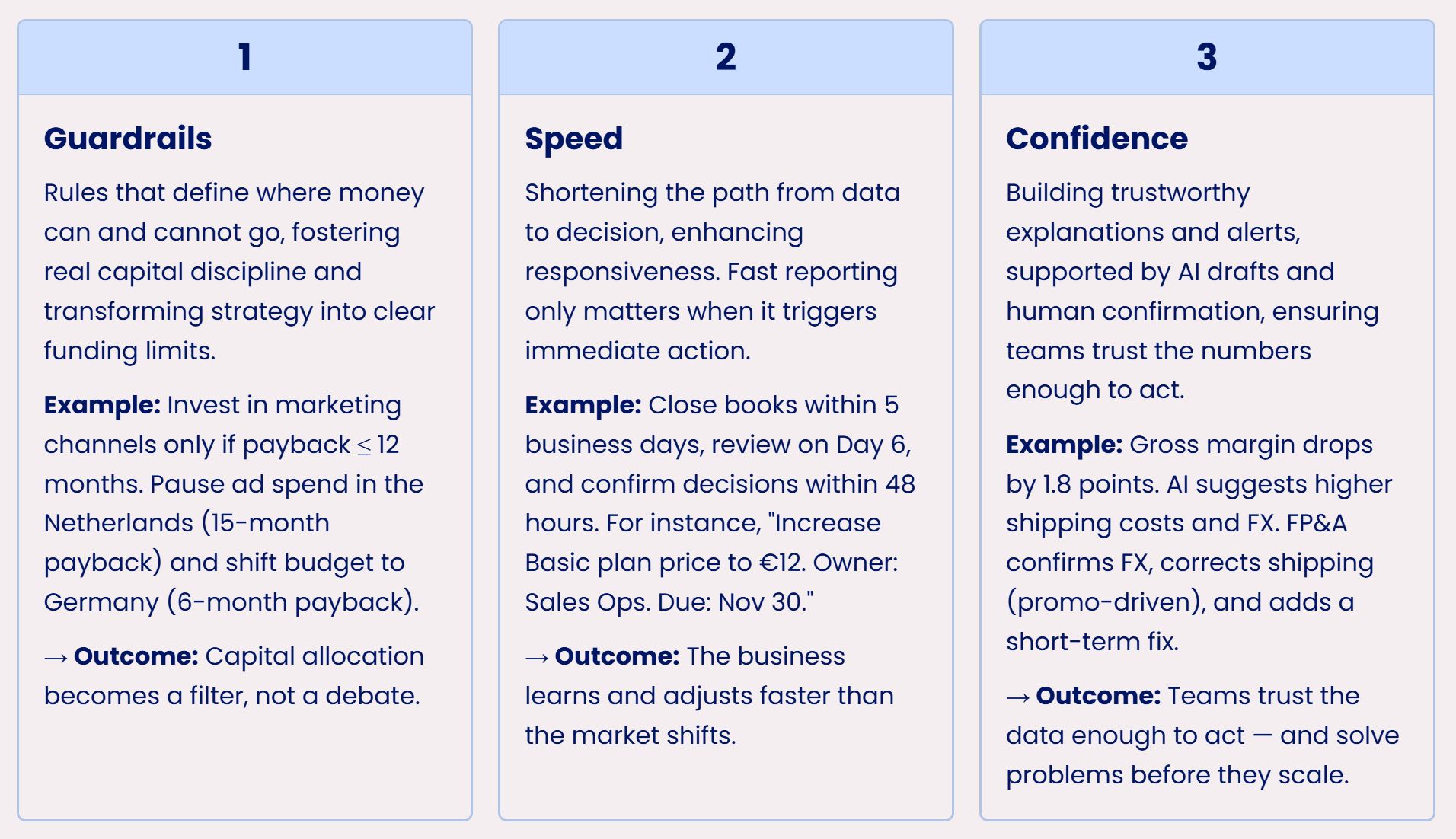

What great Management Accounting delivers

Great finance teams don’t forecast better. They decide faster.

3. Build the Pack - without boiling the ocean

Start with the latest month - not a forecast festival. The goal is rhythm, not reinvention. Your management pack should look the same every time so people navigate it on muscle memory. That’s how it becomes a decision tool, not a data dump.

Management accounting builds on statutory accounting - it doesn’t replace it.

The same data powers both, but how you structure it determines its value. A chart of accounts that’s too coarse hides insights; one that’s granular and clean turns numbers into navigation.

Granularity connects results to real drivers. Quality means postings are consistent so trends show business truth, not accou

A few ground rules:

Pick one anchor comparator (usually vs. budget). Add others only if they earn their space.

Keep the rhythm fixed. The story changes, the structure doesn’t.

Stay concise. Eight to twelve pages is plenty — Income Statement, Cash, Gross Margin by stream, KPIs, EBIT waterfall, Appendix.

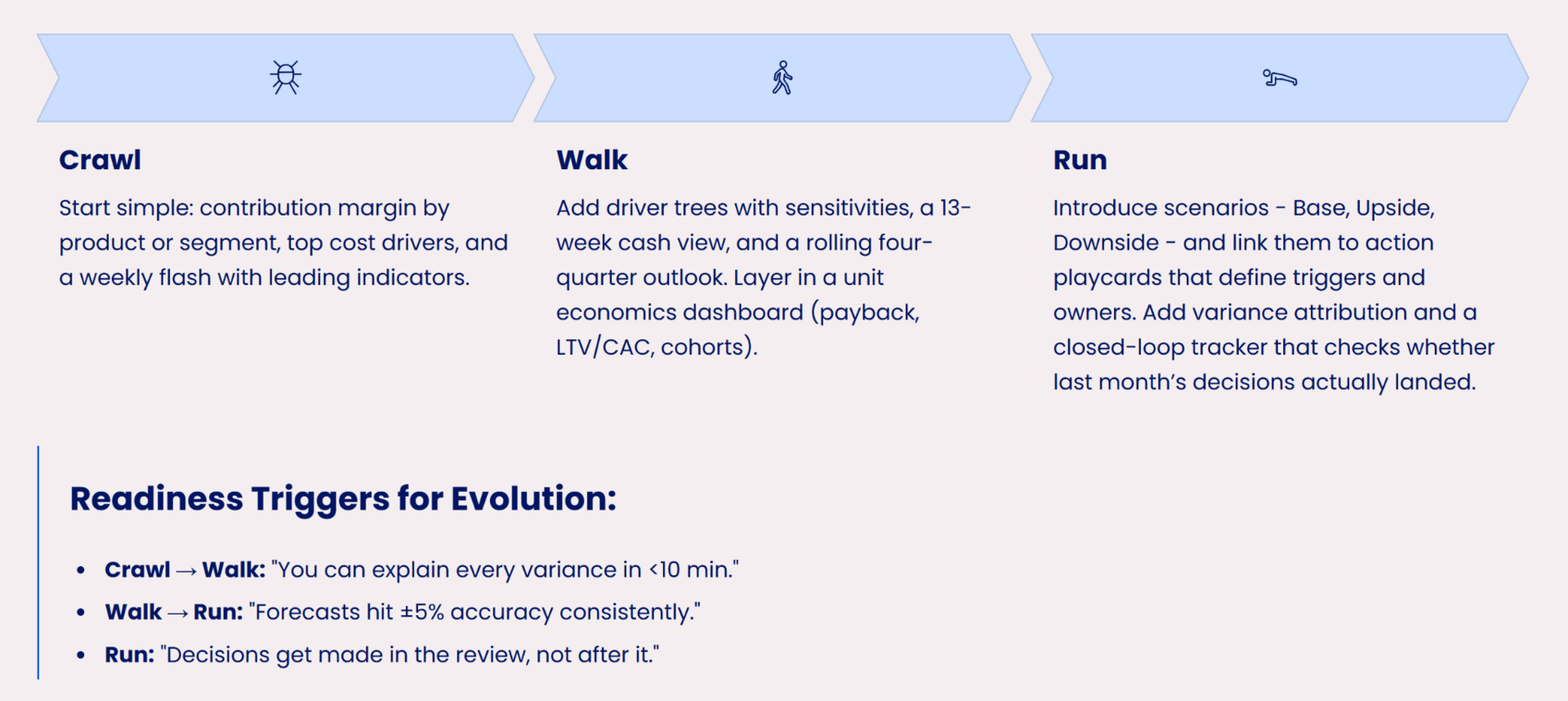

Once the base format is stable, build maturity in stages.

4. The Rhythm that Makes it Work - from close to consequence

A great management pack doesn’t just inform - it drives motion.

Think of it like a product: it has an owner, a release cadence, and clear user outcomes.

The goal isn’t to close faster for its own sake; it’s to shrink the time between signal and decision. A five-day close isn’t an accounting flex - it’s a feedback loop that keeps the business learning at speed. (If you want to learn more about how to speed up your monthly closing, read this From Month-End Hell to 5-Day Close).

How to make the rhythm stick:

Close within five business days. Fast enough for relevance, accurate enough for trust.

Hold monthly reviews. Revenue to EBIT should be rock solid every time; judgment calls can true up quarterly.

Lead with the headline. Each section starts with a single line: What moved → Why → What changes → Who owns it → By when.

Build in follow-through. Every new review starts by revisiting last month's actions green, amber, red. What got fixed? What didn't? What's blocking? If a decision stays red for 2 months, escalate or kill it. Zombie actions destroy credibility faster than bad numbers.

Tie metrics to ownership. Connect KPIs directly to OKRs and SLAs so decisions land in the line, not in slides.

When this rhythm clicks, the pack stops being a report.

It becomes the operating drumbeat of the company - the CFO’s system for turning insight into execution.

5. From Insight to Execution - data, tools, and a bit of AI

Technology doesn’t fix chaos. Process does.

Automation only works when the foundations are solid - clear data, defined ownership, and a stable operating rhythm. Once that’s in place, tech becomes an amplifier. Processes are key (if you want to read more on processes, here’s our episode on The Process Revival: Digital Age Needs Structure)

The aim isn’t a prettier dashboard. It’s a tighter loop: data turns into insight, insight turns into action, and every action feeds back into the model.

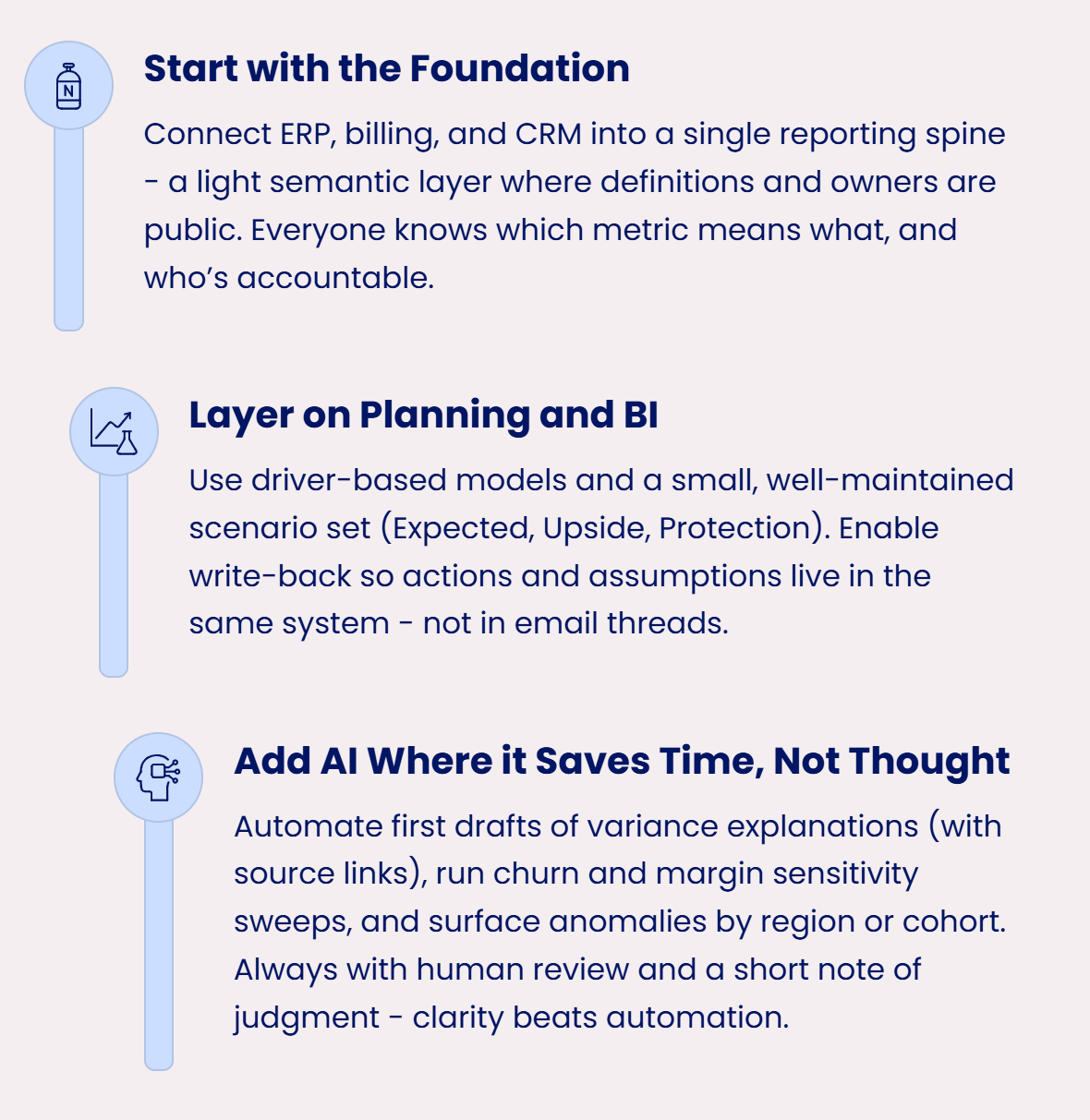

How to wire it right:

When data, process, and rhythm are aligned, the finance stack becomes a feedback system, not a filing cabinet.

Automation doesn’t replace finance judgment. It scales it.

Bottom Line

Management accounting isn’t another report.

It’s the operating system for decisions.

The close tells you what happened. The pack tells you what to do next.

Keep the structure steady, the cadence fast, and the ownership visible.

Finance earns its seat not by reporting the business - but by running it.

🔎 CFO Watchlist

Nvidia and Deutsche Telekom invest €1B in Germany’s first “AI factory”

Nvidia and Deutsche Telekom have announced a €1 billion partnership to build an Industrial AI Cloud in Munich - a project set to boost Germany’s AI computing capacity by 50%. The new data center will host over 10,000 Nvidia Blackwell GPUs, providing secure, in-country AI services for German companies in compliance with data sovereignty rules. Early partners include Agile Robots, Perplexity, and SAP, with operations planned to start in early 2026. The initiative underscores Europe’s push to reduce dependence on U.S. infrastructure and reclaim ground in industrial AI.

🔗 Read more: Nvidia, Deutsche Telekom strike €1B partnership for a data center in Munich | TechCrunch

Build the AI app that solves your CFO headache

Light, Lovable, and McKinsey are joining forces for a full-day finance hackathon in Berlin on November 14. Forget panels and PowerPoint - this is hands-on: finance teams build real AI tools to fix their biggest headaches. With guidance from Light’s AI-native finance experts, Lovable’s app-building platform, and McKinsey’s QuantumBlack team, participants will walk away with working prototypes ready to use.

Free Pro access to four major AI tools - for a year

Perplexity is offering 12 months of free access to its Pro version — which includes premium models like GPT-5, Claude Sonnet 4.5, Gemini 2.5 Flash, and Perplexity Sonar. The deal runs until December 31, 2025, and is available to new users with a valid PayPal account created before September 1, 2025. Once activated, users can disable data retention and voice settings for privacy. For finance teams experimenting with copilots, this may be the cheapest way to test the leading models side-by-side before committing to enterprise contracts.

🔗 Read more: (80) Post | LinkedIn

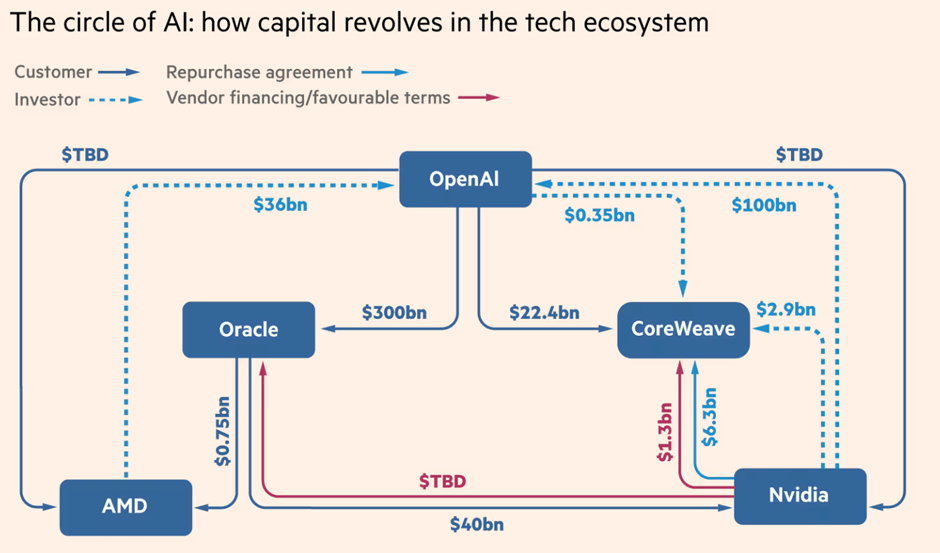

OpenAI’s trillion-dollar infrastructure gamble

OpenAI is reportedly preparing to spend more than $1 trillion on computing power — a scale of investment never seen in corporate history. Deals with AMD, Nvidia, and Oracle highlight an emerging web of financial dependencies across Big Tech. The company’s latest agreements could see AMD effectively grant OpenAI up to 10 % of its stock, while Nvidia’s proposed $100 billion equity plan ties directly to chip orders. The question for CFOs and investors alike: can the AI boom justify this capital intensity, or are we already in bubble territory?

(source: Financial Times/ Morgan Stanley)

🌐 Finance Collective DACH

Your go-to CFO Network

(by Simone)

Looking for a place where you & your Team can connect with like-minded Finance Leaders? |  |

CLOSING REMARKS

Thanks for reading 💛

Send your feedback, suggestions, or requests to feature something in future editions to [email protected]. We’d love to include your input.

Follow us on LinkedIn for more updates!

CFO Playbook reflects our personal opinions, not professional advice.